NMIMS Centre for Distance and Online Education (NCDOE)

Course: Consumer Behaviour

Internal Assignment Applicable for December 2024 Examination

Assignment Marks: 30

Instructions

- All questions carry equal marks.

- All questions are compulsory.

- All answers must be explained in:

- Not more than 1000 words for Question 1 and Question 2.

- Not more than 500 words for each subsection of Question 3.

- Use relevant examples and illustrations where possible.

- All answers must be written individually. Discussion and group work are not advisable.

- Students are free to refer to books, reference materials, websites, or the internet for attempting their assignments. However, copy-pasting content verbatim from sources is strictly prohibited.

- Assignments must be written in the student’s own words. Copying assignments from peers is not allowed.

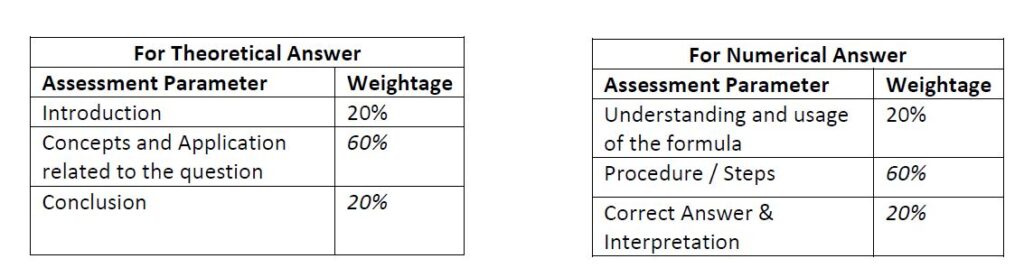

- Follow the below parameters while answering the assignment questions:

Questions

1. Consumer Expectations from Products (10 Marks)

Question:

What are the expectations of consumers from products, for example, smartphones? Share an example of your experience regarding how you decide which smartphone to purchase. Highlight the parameters a customer considers when purchasing a new smartphone.

2. Brand Ambassador Concept (10 Marks)

Question:

Imagine a new deodorant is about to be launched in the market. The customer is given the option to become the brand ambassador for this deodorant. What concept is being applied here?

3. Case Study: Changing Consumption Patterns in Bharath (10 Marks)

Case Study Summary:

Growing nuclear families powering premium FMCG purchases (Kantar Report)

With nuclear family structures in Bharath on the rise, consumption habits, too, are changing, observes a report by Kantar. The report notes that large families don’t necessarily buy larger packs. Additionally, home and hygiene items like floor and utensil cleaners, snacking, and beverages are more commonly opted for by nuclear households. The report also highlights that the penetration of the premium segment is relatively higher in nuclear families. For instance, in washing powders, the penetration stands at 68% for nuclear families, compared to 50% in joint families. In tea, the penetration stands at 19% in joint families and 38% in nuclear families.

It is observed that joint families don’t necessarily prefer large packs for consumption, and the nuclearisation of families is also leading to the premiumisation trend in fast-moving consumer goods (FMCG). “There are more households being created than there is growth in the population, and that is fundamental because family sizes are becoming smaller, and nuclear families as a phenomenon are growing,” says K Ramakrishnan, managing director, South Asia, Worldpanel Division at Kantar.

“In terms of affluence, there is no difference between a nuclear family and a joint family, and their overall consumption is also similar. However, when you consider consumption per capita, there is a difference. The data shows that nuclear families are slightly more oriented towards consumption and premium brands,” he says. Kantar also released its report on the most chosen in-home and out-of-home (OOH) FMCG brands based on consumer reach point (CRP). Parle holds the top spot for a record 11th year in a row in the in-home segment, followed by Britannia, Amul, Clinic Plus, and Tata Consumer Products. Parle had a CRP score of 7,449 million. CRP considers the actual purchase made by the consumers and the frequency at which these purchases are made in a year. They measure the mass appeal of the brand (reflected in penetration of the brand) and the feel towards the brand (reflected in the number of times it is bought). In the OOH segment, Britannia took the top spot with 498 million CRP, followed by Haldiram’s, Cadbury, Balaji, and Parle. The top five brands are all in the snacking category. The report highlighted that in 2022, four new brands — Balaji, Lux, Sunsilk, and Nirma — joined the billion CRP club. Over the past five years, the number of brands in the billion CRP club has increased from 16 to 28.

The report also indicated that beverages were the fastest-growing category in 2022 compared to 2021, with a growth rate of 24%. Kantar also mentioned that more than half of the brands experienced growth in terms of CRP, with the highest number being in the food and beverage categories. Dairy brands have low penetration but higher frequency, resulting in more reach points. “Consumer choice is the ultimate strength test for a brand, and brand footprint has been a widely acclaimed ranking system to measure this for the past 10 years. As we have seen over the years, consumers are making increasing trips for purchases, and that adds to their options and, in turn, their choices. This is reflected in the constant increase in CRP we observe. As purchases for OOH consumption are on the rise and seem to have different choice triggers, we found it necessary to introduce a ranking specifically for these categories, where there is a significant OOH component,” says Ramakrishnan.

Questions:

a) How are the consumption habits and patterns changing in families in Bharath today? What is CRP, and how are consumers reacting to brands? (5 Marks)

b) How is CRP evolving in the Bharath context? Elaborate on Kantar’s findings. (5 Marks)